Roll by ADP's fast factsPricing: Starts at $29 fixed fee per month plus $5 per employee per month Features:

|

Roll by ADP is an online payroll processing solution that makes it easy to manage payroll on the go. It has a chat-based design that allows users to run payroll through text commands. In this Roll by ADP review, we share its pros, cons, pricing, standout features, review methodology and other information to help you determine if it’s the right payroll software for your needs. If you think Roll by ADP isn’t a good fit, you can consider the alternatives we have shared at the bottom.

Jump to:

- Pricing

- Key features of Roll by ADP

- Pros

- Cons

- If Roll by ADP isn’t ideal for you, check out these alternatives

- Review methodology

Pricing

Roll by ADP is priced at $29 per month plus $5 per employee per month. You get unlimited payroll runs in all 50 U.S. states for employees and contractors, no long-term contracts and a free three-month trial period. You also get several other payroll features, including employee self-service, automatic tax deductions, wage garnishments, off-cycle payments and an AI-driven error check in real time.

SEE: Check out our comprehensive list of the top payroll solutions of 2023.

Key features of Roll by ADP

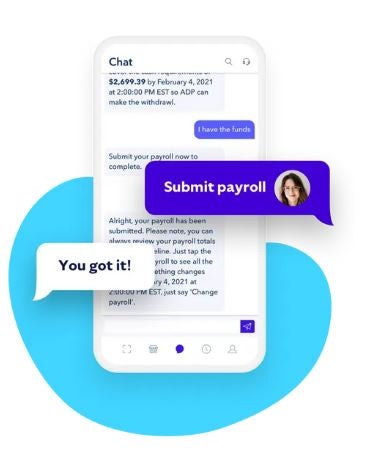

Chat-based commands

At the heart of Roll by ADP is a chat-based engine that’s programmed to function with minimal inputs. You can enter chat commands to perform various tasks such as running payroll, updating employee information or adding new employees. The chat-based engine matches your commands or requests to relevant information and guides you through the next steps. Once you master the commands, you will find the system becomes more efficient.

Payroll processing

With Roll by ADP, you get unlimited pay runs, so you don’t have to be concerned by how often you need to process payroll. You can have multiple pay schedules. The software will automatically calculate payments and deductions based on built-in rules that cover all 50 U.S. states. Although you can print 1099 forms, you don’t have access to 1099 reporting. Some competitors offer only two-day direct deposit but with Roll by ADP you get next-day payments.

Intelligent Assistance

Powered by AI, the Intelligent Assistance tools help streamline payroll tasks. This includes an AI-driven error check feature that highlights any errors in real time. You also get smart alerts, notifications, pay schedule reminders and to-do lists to ensure you are on top of your payroll tasks. The AI tools analyze your regular payroll runs and if it spots an anomaly, it highlights it to ensure you are aware of the change.

Data security

Roll by ADP offers advanced security tools and technology, including data encryption, incident management, security alerts and ISO 9001 and 27001 certifications. ADP also runs regular security updates to help protect against new security threats. You also get access to ADP’s Critical Incident Response Centers across the globe.

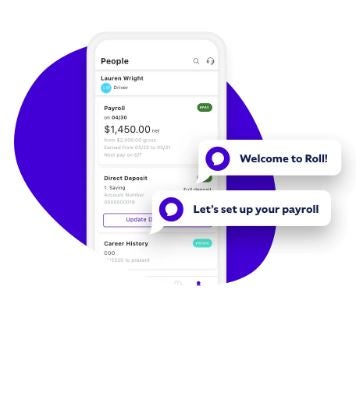

Employee self-service portal

This isn’t a unique feature, as several competitors also offer such a portal. However, the user interface of Roll by ADP makes this feature stand out from the rest. Users can access their payroll information, request time off, update their personal details and perform other tasks.

Pros

- Simple to use with minimal data entry requirements.

- Solid payroll features.

- Handles both employee and contractor payroll

- Three-month trial period.

- Next-day direct deposit.

Cons

- Only integrates with QuickBooks Online for accounting.

- 1099 reporting not included.

- Chat commands require some time to get used to.

- Time tracking functionality is limited.

If Roll by ADP isn’t ideal for you, check out these alternatives

Gusto

Gusto is a cloud-based payroll solution for small and medium-sized businesses. While Roll by ADP has extremely limited integration capability, Gusto gives you an extensive range of integrations. Gusto doesn’t offer the 24/7 customer support provided by ADP, but it offers more features. Even the lower plan level of Gusto offers automatic tax filing, payroll processing, direction deposit and wage garnishments. You can also scale up with Gusto, as it offers multiple plans. The pricing starts at $40 per month plus $6 per employee per month.

- You can read the full Gusto review for more information.

- Visit Gusto.

Square Payroll

While Roll by ADP is loaded with features, Square Payroll has fewer features but is simpler to use. For businesses that are looking for new payroll software but want to be up and running as quickly as possible, Square Payroll might be a better option. Another type of business that may find Square Payroll a better fit is one that already uses Square applications. The pricing for Square Payroll has one plan only, with pricing set at a $25 monthly subscription fee plus $5 per employee per month.

- Read the full Square Payroll review for more information.

- Visit Square Payroll.

QuickBooks Payroll

For businesses already using QuickBooks accounting software, it may be an easy choice to use QuickBooks Payroll to manage payments to employees and contractors. You get some of the same features in QuickBooks Payroll as Roll by ADP, such as next-day direct deposit and unlimited pay runs. Pricing for QuickBooks Payroll starts at $37.50 per month plus $5 for every employee.

- You can read the full QuickBooks Online Payroll review for more information.

- Visit QuickBooks Online Payroll.

Review methodology

When reviewing Roll by ADP, we considered several factors, including the functionality of the software, including the tools for payroll processing, tax compliance, employee self-service, mobile app and customer service. Next, we reviewed the user interface to determine if Roll by ADP offers easy adoption, smooth navigation and efficiency. Finally, we looked at user reviews and feedback to have a better understanding of the pros and cons of the software.