Our star rating: 3.5 out of 5

Paychex is one of the top payroll software solutions that helps businesses automate payroll, HR and other human-capital services. In order for you to determine if Paychex is ideal for your business — specifically, if its cloud-based payroll software application, Paychex Flex, will work for you — read this breakdown of the software’s notable features, pros, cons, pricing details and main competitors.

Jump to:

- What is Paychex?

- How much does Paychex charge for payroll services?

- Paychex’s features

- Pros and cons of Paychex

- How much does Paychex cost?

- Top alternatives to Paychex

- Is Paychex right for my organization?

- Methodology

What is Paychex?

Paychex is a cloud-based payroll and HR solution that provides businesses with HR services, tax preparation, benefits administration, time and attendance services.

While the company offers a few different types of payroll solutions, including Paychex PEO, its most popular product is its cloud-based payroll and HR software tool, Paychex Flex.

SEE: Learn about QuickBooks Online and its pricing, features, pros and cons.

With Paychex Flex, businesses can offer their employees a variety of payment methods, such as direct deposit, paper checks and payroll cards. The payroll solution also makes it easy for each employee to choose the sequence or frequency in which they want to be paid, as there are options for weekly, biweekly and monthly payments.

How much does Paychex charge for payroll services?

Paychex’s payroll services start at $39 a month plus $5 per employee paid per month. The pricing listed on its site is for Paychex’s cheapest plan, Paychex Flex Essentials. The two more thorough Paychex Flex plans, Paychex Flex Select and Pro, require potential customers to request a custom quote (Figure A).

Figure A

Paychex Flex Essentials is intended for small businesses with fewer than 20 employees. It includes full-service payroll processing and tax administration, an employee self-service payroll app, employee onboarding tools and HR library access.

Paychex Flex Select includes all of Paychex Flex Essential’s features with an employee learning management system, hiring tools and accounting software integration.

Paychex Flex Pro adds a slew of HR tools (such as an employee handbook template) and a few more payroll features (such as wage garnishment).

Regardless of the plan they pick, customers can add a variety of extra payroll and HR features for an additional fee:

- Time and attendance software.

- Workers’ compensation insurance integration.

- Employee benefits administration.

- Employee retirement plan options.

- Third-party software integration.

Paychex Flex plans were designed with small and midsize businesses in mind. The company also offers an enterprise-level solution, Paychex Enterprise, which is a comprehensive, fully customizable payroll solution for businesses with hundreds of employees.

Paychex’s features

Payroll processing

Payroll processing is at the core of Paychex’s services. It automatically calculates paychecks for both hourly and salaried employees, deducts taxes, and lets you pay employees through a variety of methods. Paychex’s precheck feature allows employees to review their scheduled payments to reduce payment-related issues.

Comprehensive human resource services

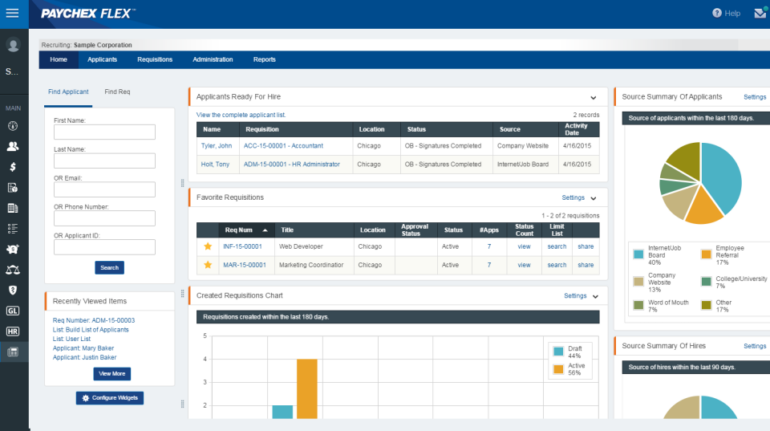

Paychex Flex has more substantial HR features than key payroll software competitors like Gusto Payroll. Every plan has employee hiring and onboarding features and access to Paychex’s thorough HR resource library.

Higher-tier plans include a range of HR services including hiring, applicant tracking, employee development and records management that can help organizations streamline these tasks. In addition, the platform has a team of dedicated HR experts that offer more advanced HR assistance to organizations that may have complicated HR issues to resolve.

Payment options

Paychex offers flexible payment options through direct deposit, paper checks and prepaid cards. For businesses that still offer their employers paper check payments, Paychex provides a Readychex service to make this work. There is also an on-demand pay option, also known as earned wage access, that allows employees access to their wages when needed without waiting for the next payroll cycle (Figure B).

Figure B

Tax management

Tax management is an especially difficult aspect of payroll that requires expert handling. Paychex offers a system that calculates, files and processes payroll taxes at the federal, state and local levels. With this service, businesses will not need to worry about meeting tax deduction regulations, as the system takes care of that automatically.

Business insurance

Paychex offers add-on business insurance solutions that provide comprehensive coverage for your properties, organizations and employees. Some of the areas covered are cyber liability insurance, employment practices liability insurance, commercial auto insurance and commercial property insurance.

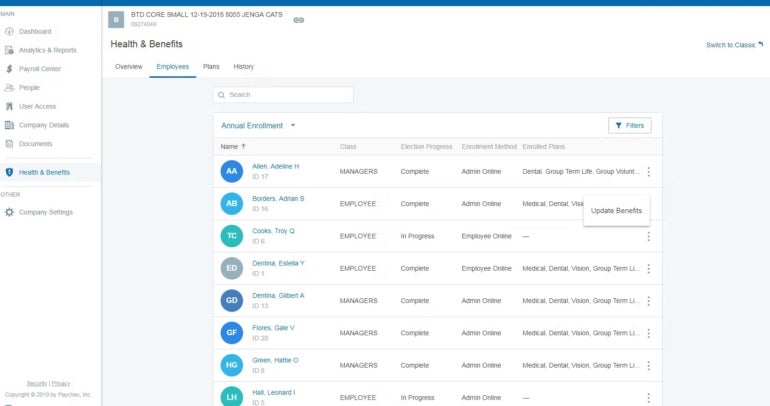

Employee benefits

Through Paychex, businesses can find group health benefits and employee retirement plans, such as 401(k)s. For an additional fee, you can add benefits administration to your Paychex plan. Employees can use their Paychex dashboard to sign up for benefits during enrollment periods, check their benefits, view payslips and see their paycheck deductions (Figure C).

Figure C

Pros and cons of Paychex

Pros

Analytics and reporting

Paychex helps businesses create personalized analytics and reports. The platform also has customizable templates to help businesses track and display critical data.

Attendance and time tracking

Like most other payroll and HR software systems, Paychex has a native time-tracking product that employees can use to clock in and out, submit time-off requests and view their hours worked. This data integrates automatically with Paychex’s payroll software to calculate paycheck amounts. Paychex’s scheduling software is an optional product that costs an additional fee.

Simplifies the hiring processes

The platform helps businesses screen, collect and centralize candidates’ data from when the candidates submit their resumes for an interview until the application window is closed. While every Paychex payroll plan includes automatic state new-hire reporting and basic hiring and onboarding features, only the Paychex Pro plan includes pre-employment screening. Most other hiring tools are add-on products that cost an extra fee.

Supports third-party integrations

Paychex provides a variety of third-party software integrations for easy data sharing. Through its API library, organizations can easily connect with other software for accounting, HR and productivity, reducing the time-consuming process of manual configurations of third-party apps.

Mobile app

Paychex has one mobile payroll app for employees and another for employers who want to check payroll data and schedule a payroll run from their phone. Both apps are highly rated on both the App Store and Google Play.

Cons

Pricing is not expressly stated

Apart from Paychex Flex’s cheapest plan, most Paychex plan prices are unavailable on its website, which requires contacting the vendor for a quote for each service.

Additional fees for essential services

Paychex charges fees for crucial payroll tools that many of the best payroll software tools bundle into their base price. All Paychex users, regardless of the plan tier they choose, must pay extra for services like benefits management, time and attendance tracking, general ledger integration, workers’ compensation integration and third-party app integration.

No free trial

Paychex does not offer a free trial, which many businesses like to do before making this type of financial commitment.

Top alternatives to Paychex

If Paychex doesn’t seem to have all of the features your company needs or perhaps isn’t in your budget, here are payroll alternatives to consider.

Gusto

Like Paychex, Gusto is payroll management software that includes payment, hiring, insurance and other business support solutions in one offering.

While Gusto’s payroll service has fewer HR features than Paychex, it includes free employee benefits management and free integration with the most popular business apps, especially accounting software like Xero and FreshBooks.

Gusto starts at $40 a month plus $6 per employee per month. It has three plans, each one with an increasing number of HR features.

SEE: Gusto vs Paychex: Compare top payroll software (TechRepublic)

OnPay

OnPay offers HR, payroll and employee management in one suite. With its one-month free trial, potential customers can get a feel of the product without making a payment. While OnPay has more HR features than Gusto, including compliance alerts and HR template access, it doesn’t have the same robust HR focus as Paychex.

OnPay is also less scalable than multi-plan payroll solutions like Gusto, Paychex and ADP: Its single payroll plan costs $40 a month plus $6 per employee per month.

Paylocity

Paylocity offers an all-in-one solution for businesses that need to administer payroll, benefits management, HR, time and attendance from one platform. The platform is best suited for small and medium-sized businesses. Unlike Paychex Flex, Paylocity doesn’t have any enterprise-level payroll solutions.

Paylocity doesn’t list its prices online. Small-business owners should contact Paylocity directly for a quote.

QuickBooks Payroll

QuickBooks Online Payroll is Intuit QuickBooks’ cloud-based payroll solution. Like Paychex, QuickBooks Payroll offers full-service payroll processing and tax administration along with a self-service payroll app for employees. Since the software was built to integrate directly with QuickBooks Online, Intuit’s popular accounting solution, QuickBooks Payroll doesn’t charge extra for you to integrate its payroll and accounting systems.

QuickBooks Online Payroll has three pricing tiers:

- QuickBooks Payroll Core costs $45 a month plus $5 per employee per month.

- QuickBooks Payroll Elite costs $75 a month plus $8 per employee per month.

- QuickBooks Payroll Premium costs $125 plus $10 per employee per month.

With each plan, you can choose either a 30-day free trial or to receive 50% off the payroll software’s base price for three months.

SEE: QuickBooks Payroll review (2023): Pricing, features, pros and cons (TechRepublic)

Is Paychex right for my organization?

If you run a large organization with complex payroll needs, you should consider Paychex because it has numerous customizations. Its features are designed to scale as your business needs grow. In addition, organizations that still run on the paper check means of payment can adopt Paychex because it features a tool that accommodates such traditional means of payment.

If you’re comfortable getting started with a software tool without trying a free version, Paychex lets users dive into the complete package for a fee. On the other hand, if you’re looking for top payroll processing services for small businesses, or a payroll solution that offers a free trial and easy to find pricing details, check out QuickBooks Online Payroll and OnPay.

Methodology

To write our Paychex review, we read verified Paychex customer reviews, thoroughly researched Paychex’s features, and reviewed Paychex’s self-guided desktop and mobile demos.